Market Making

A leading Market Maker in the region since 2017.

Al Ramz has been championing Market Making in the UAE since the launch of the regulations in both Markets and is now expanding business regionally.

As a primary Market Maker in the region, we have consistently increased trade volume to become one of the largest in the GCC. We continue to expand our presence across the GCC to countries such as Saudi and Oman in both cash equities and derivatives markets.

Improved stock liquidity

Board Directors and management are responsible to address matters affecting stock liquidity and pricing. Our track record as a liquidity provider in the UAE financial markets along with our robust credentials in the field have positioned us to assist clients with stock liquidity.

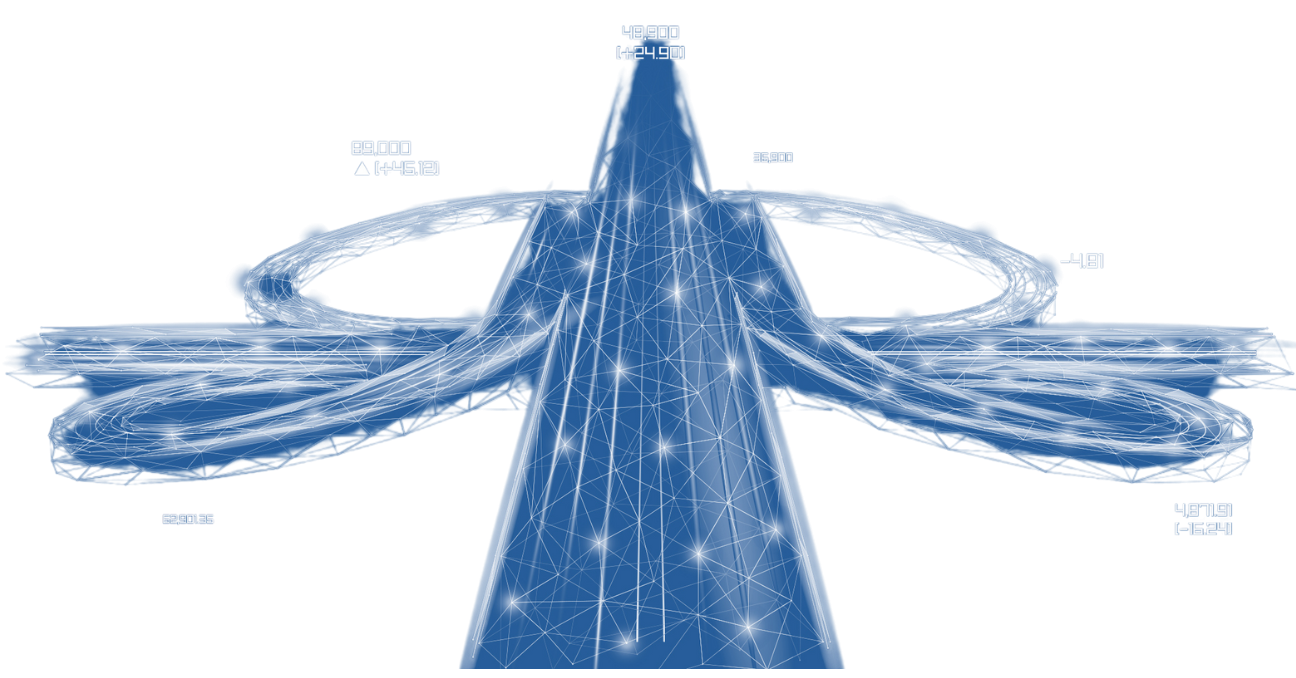

LIQUIDITY PROVIDING

A leading Liquidity Provider in the region since 2017.

Liquidity Providing aims to improve overall stock liquidity and orderbook health. As a result, this reduces bid/ask spread and overall stock volatility caused by trade flow imbalance and inconsistent liquidity.

Liquidity Providing mandates are tailored to meet specific requirements of publicly listed companies. Mandate paramaters are initially outlines and calibrated subsequenly to align outcomes which may include assisting companies in achieving Emerging Market's Indices inclusion status.